Silva Capital employs a four-stage investment process designed to provide repeatable, superior investment performance:

Our investment process begins with analysis of the economic fundamentals and policy environments of the countries we target for holdings. Through research into central bank policies, political institutions, and yield curve analysis we seek to identify discrepancies between fundamental value and market prices.

We complement fundamental research with quantitative analytics combining technical indicators with volatility and correlation metrics. Alongside the valuation-discrepancy signals delivered by our fundamental research, these indicators provide guidance for portfolio construction and strategy execution.

Output from fundamental and technical analyses are used to construct portfolios designed to maximize returns while managing exposure to risk. Managers will take long/short positions where justified by pricing discrepancies relative to our fundamental models and/or where market positioning results in technically driven buy/sell signals.

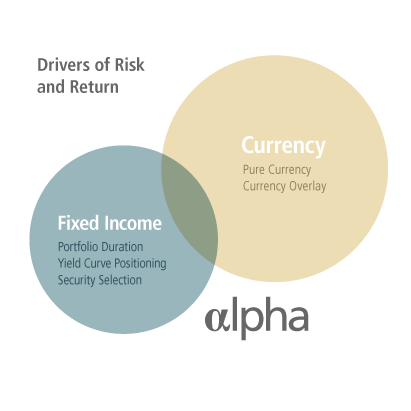

Silva Capital expresses investment theses in fixed income, rates, and currency markets. Our fixed income investments are made in hard and local currency, with an emphasis on sovereign and quasi-sovereign debt.